Pvm Accounting Fundamentals Explained

Pvm Accounting Fundamentals Explained

Blog Article

Pvm Accounting Can Be Fun For Everyone

Table of ContentsThe Pvm Accounting DiariesWhat Does Pvm Accounting Do?The Ultimate Guide To Pvm AccountingPvm Accounting Fundamentals ExplainedAn Unbiased View of Pvm AccountingUnknown Facts About Pvm AccountingSome Of Pvm AccountingSome Known Facts About Pvm Accounting.

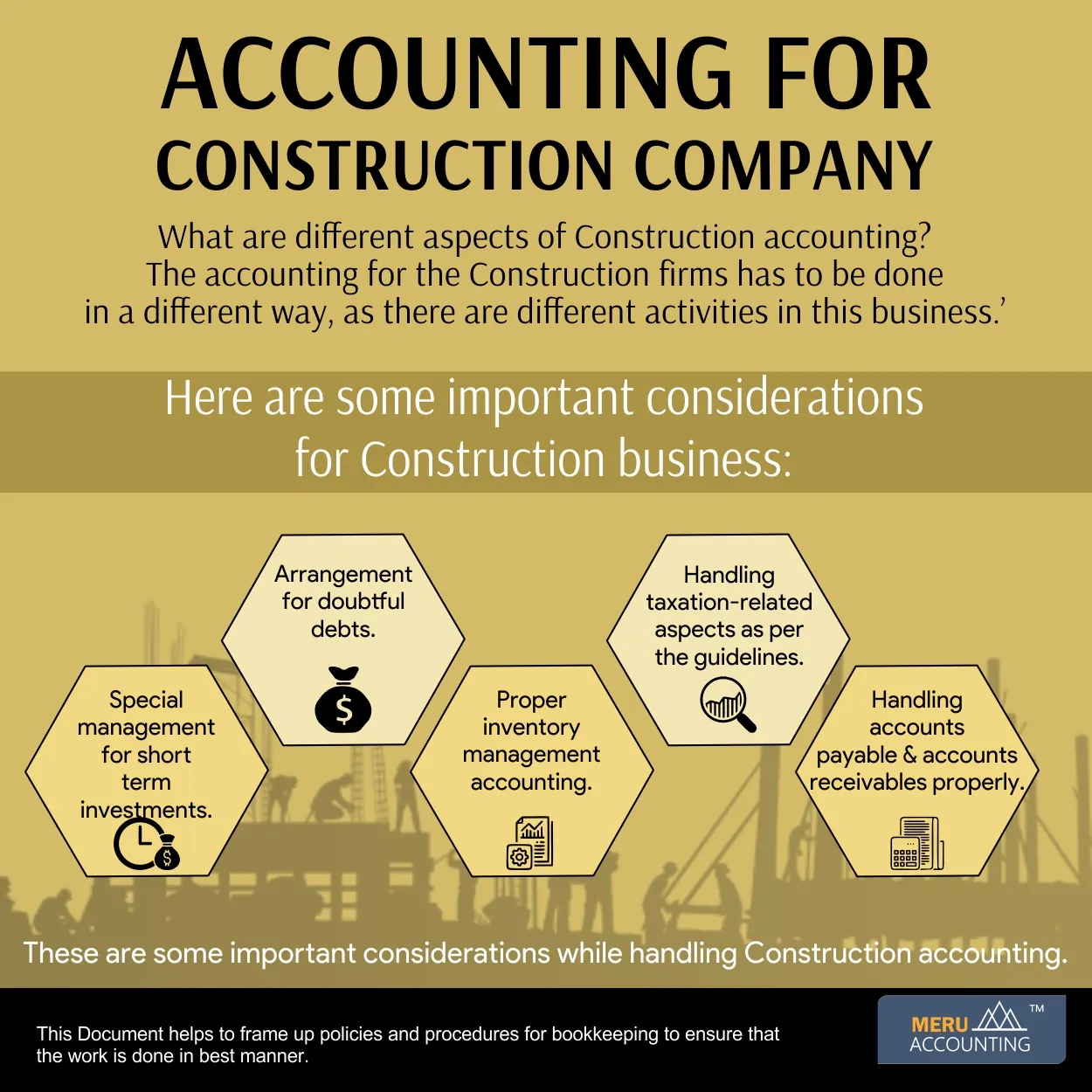

Among the primary factors for executing audit in building tasks is the requirement for economic control and administration. Building and construction jobs usually require significant financial investments in labor, materials, equipment, and various other resources. Proper accountancy enables stakeholders to monitor and take care of these economic resources efficiently. Audit systems give real-time insights right into job expenses, earnings, and productivity, enabling task managers to quickly determine prospective concerns and take restorative activities.

Audit systems enable companies to check money flows in real-time, making sure sufficient funds are offered to cover expenditures and satisfy economic obligations. Efficient money circulation administration assists prevent liquidity situations and maintains the job on track. https://www.pageorama.com/?p=pvmaccount1ng. Construction jobs are subject to numerous monetary requireds and reporting demands. Correct bookkeeping makes certain that all economic transactions are taped precisely and that the project conforms with accountancy standards and legal arrangements.

Getting The Pvm Accounting To Work

This lessens waste and improves job efficiency. To better understand the importance of audit in building, it's additionally crucial to differentiate between building and construction administration audit and job monitoring audit.

It concentrates on the monetary elements of specific building and construction projects, such as expense estimate, price control, budgeting, and capital administration for a specific project. Both types of audit are necessary, and they complement each other. Building monitoring bookkeeping makes certain the business's monetary wellness, while project administration accountancy ensures the economic success of individual jobs.

4 Simple Techniques For Pvm Accounting

An important thinker is needed, that will certainly function with others to make choices within their locations of obligation and to boost upon the areas' work processes. The placement will certainly communicate with state, university controller personnel, campus department personnel, and academic scientists. He or she is anticipated to be self-directed once the first discovering curve relapses.

Pvm Accounting - Questions

A Building and construction Accounting professional is in charge of handling the economic aspects of building and construction jobs, including budgeting, expense tracking, financial reporting, and conformity with regulative needs. They work carefully with project supervisors, service providers, and stakeholders to guarantee precise economic documents, cost controls, and timely repayments. Their knowledge in building audit principles, task costing, and monetary evaluation is vital for effective financial administration within the building and construction sector.

Not known Facts About Pvm Accounting

Pay-roll tax obligations are taxes on a worker's gross income. The revenues from pay-roll tax obligations are utilized to money see this public programs; as such, the funds collected go directly to those programs rather of the Internal Income Solution (INTERNAL REVENUE SERVICE).

Note that there is an added 0.9% tax for high-income earnersmarried taxpayers that make over $250,000 or single taxpayers making over $200,000. Incomes from this tax obligation go toward federal and state joblessness funds to assist workers that have lost their work.

8 Easy Facts About Pvm Accounting Explained

Your deposits have to be made either on a month-to-month or semi-weekly schedulean political election you make prior to each schedule year (construction bookkeeping). Monthly payments - https://worldcosplay.net/member/1768246. A monthly repayment should be made by the 15th of the following month.

So look after your obligationsand your employeesby making total payroll tax obligation payments on time. Collection and repayment aren't your only tax responsibilities. You'll likewise need to report these amounts (and various other information) frequently to the IRS. For FICA tax obligation (as well as federal revenue tax), you have to finish and file Form 941, Company's Quarterly Federal Tax obligation Return.

Pvm Accounting Things To Know Before You Buy

Every state has its very own unemployment tax obligation (called SUTA or UI). This is due to the fact that your company's market, years in organization and unemployment history can all establish the portion made use of to calculate the quantity due.

See This Report on Pvm Accounting

The collection, remittance and reporting of state and local-level taxes depend on the governments that impose the tax obligations. Plainly, the topic of pay-roll tax obligations involves plenty of relocating parts and covers a vast range of accountancy knowledge.

This site uses cookies to boost your experience while you browse via the internet site. Out of these cookies, the cookies that are categorized as required are saved on your internet browser as they are vital for the working of basic functionalities of the internet site. We additionally utilize third-party cookies that assist us examine and understand just how you use this website.

Report this page